The Declaración de la Renta is Spain’s yearly tax form. Unlike in other countries, everyone has to do it. There are a few pointers following for the Declaración de la Renta due in 2018 (which reports on fiscal year 2017). These are designed for people working in companies – so if you’re freelancing in Spain or a small business owner you should check this article instead.

Disclaimer: I’m not a legal/financial consultant, so do bear in mind that these are just observations based on my own experience of doing the Declaración de la Renta.

- Do you need to do the Declaración de la Renta? When?

- The basics of doing your Declaración de la Renta

- Changing and adding information

Do you need to do the Declaración de la Renta?

The Declaración de la Renta is obligatory for all Spanish citizens earning over €22,000. If you’re not working, you have an obligation to do the Declaración de la Renta if you earn over €1,000 from odd freelance jobs or other economic activity.

For 2018, the deadline has already passed to do the Declaración de la Renta

Doing the Declaración de la Renta – the basics

You can now do the Declaración de la Renta online using this link.

Click on “Obtención del número de referencia” to confirm your identify and get a reference number. There are 3 ways you can do this:

Click on “Obtención del número de referencia” to confirm your identify and get a reference number. There are 3 ways you can do this:

- Inputting the total amount you paid (or received) in last year’s Declaración de la Renta

- With a Certificado Digital (if you have one)

- Requesting to have a PIN code sent by post

Choose one and follow through until you receive a reference number. Then, go back to the initial screen and click on “Servicio tramitación borrador/declaración (Renta WEB)”. Choose “Borrador/Declaración (Renta WEB) to get started. You’ll see that you are asked to confirm details about yourself and family.

(If you’ve done any work outside of your main job, this will appear on a pop-up now. We’ll cover declaring work outside your main job later, so for now let’s assume you haven’t seen it.)

Make any changes. Approve the information, and you will land on the “Resumen de declaraciones” summary screen.

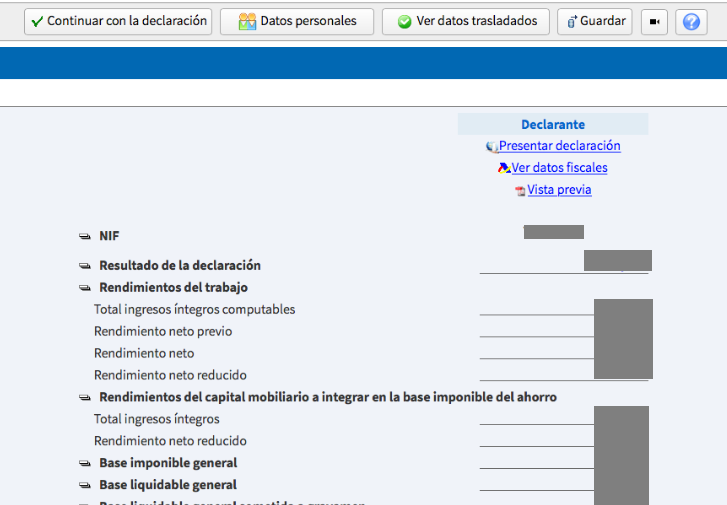

Resumen de declaraciones – reading the summary screen

- “Resultado de la declaración” (the amount you have to pay or, if negative, will receive) is at the top.

- Middle section (“Rendimientos”): reflects your earnings from companies and any financial products; as well as how much income tax and social security they’ve already paid on your behalf

- This information is provided to the government by companies and banks and pulled into your declaración de la renta automatically.

- Companies you work for are legally obliged to send you a “Certificado de retenciones” containing this information.

- Underneath: information about any deductions you receive.

If it seems like everything is correct and you don’t have anything to add or change (see below to check what these things might be!), click directly on “Presentar Declaración” in the top right. You might see a message that tells you that there are errors in your Declaración de la Renta. Don’t panic! These “errors” are normally just reminders to check your work. So if you haven’t changed anything, everything should be correct.

Then, depending on how much you need to pay, you may see the option to “fraccionar pago” (pay in instalments). Decide what you prefer and choose your payment method – “Domiciliación del pago” (payment by direct debit) is often most comfortable.

Finally, check your bank account details, sign and send.

Tip! Make sure you save a copy of your Declaración de la Renta for your records.

Adding extra information and making changes to your Declaración de la Renta

It’s rare that one size fits all – especially in tax statements. Even if nothing about your financial situation is different, it’s not a bad idea to go into the document to check your records are correct. Some changes might even entitle you to a tax rebate!

Navigating between sections

First, to access your full tax records, click on “Datos Personales” (Personal Info). It seems that from the Datos Personales screen, the navigation bar changes slightly, so you can now see “Apartados” (Sections) from the top, where you can make changes and toggle between the different pages.

![]()

![]()

![]()

Change your declaración de la renta if…

- You’ve changed address in the last year

In Page 1 of “Apartados”, make any changes at the top and then select a code under “Titularidad”. If you’re renting, for example (and have a contract), use code 3. For “Situación”, in most cases you’ll need code 1. In addition, you can use this link to check what the “Referencia catastral” (property reference number) is for your accommodation if you don’t already know.

- You’d prefer not to dedicate a proportion of your earnings to the Catholic church

Sneakily, it seems the default option has you dedicate a portion of your tax payment to the Catholic church. So I normally uncheck this on Page 3, and tick box 106 which dedicates a portion of my tax payment to social ends.

- You’ve paid for trade union subscriptions, obligatory professional collegiates or legal defence against an employer

Page 5 in “Apartados”.

- You’ve earned money from financial products or property

Fill this in on Page 6. Interest on bank accounts is pulled in automatically.

- You’ve done extra work outside your normal job

Remember that pop-up you saw in the initial stages? The distinction here is that “Trabajo” refers to anything that is your main economic activity (whenever you work for a company and are not freelancing), and “Actitividad Económica” refers to freelance work or odd jobs. Select the appropriate option.

While “Rendimientos de Trabajo” are automatically included and calculated in your Declaración, “Actividad Económica” needs to be manually inputted on Page 9.

Some niche kinds of earning (forestry, fishing, assets and goods, etc.) feature in the following pages. Unless you are running a business, it’s unlikely you will need to worry about these.

- You won a monetary prize in 2017

Lucky you! Declare this on Page 15.

- You’ve earned interest on the stock exchange

Page 16.

- You contribute to pensions, life insurance plans, etc

Pages 25-27. If your employer runs these, they will probably be filled in automatically.

- You or a dependant are disabled

Pages 2 and 29-30. Disability also appears in other sections so it may be worth checking through everything and seeking professional help with your Declaración de la Renta to make sure you get the benefits you’re entitled to.

- You bought a house before Jan 2013

In 2013, the law changed and people were no longer entitled to a tax rebate on their mortgage. However, if you’ve been in the same property since before 2013 the old law still applies to you. If you were lucky, fill in the top box on Page 37 (note that you can only claim up to a maximum of €9,040).

- You’ve invested in starting up new businesses

Business Angels can include information about their activity on Page 38 to receive a rebate.

- You’ve lived in the same rented property since Jan 1st 2015

Similar to property purchase, renters do not get a rebate if they signed their contract after Jan 2015.

If you signed before that and are earning less than €24,107.20 per year, you can claim back on rent on Page 39 by inputting the property owner’s NIF (normally the same as the DNI/NIE; should appear in your contract) in box 643 and the amount you paid over the whole year in box F. Obviously, this only applies if you have a proper, legal contract.

- You’ve donated money to charitable organisations or political parties

You can claim this as an expense on Page 40.

- You’ve invested in anything of cultural or social significance (UNESCO World Heritage in Spain, the Canary Islands, R&D/selected events in technology/the arts, etc.)

Claim this on Page 41 – 45.

Regional financial help

Furthermore, depending on the autonomous region of Spain you live in, you might be eligible for extra financial help. Check Page 47 to see if you can claim any of the items on the list. These change from year to year, so if you’re unsure what any of them mean in 2018, try Googling “declaración de la renta” + “deducción” + list item + the autonomous region you live in for more information.

Next, to check the changes you’ve made, next click “Validar” in the top navigation bar. Normally, the only “errors” that come up should be reminders to check your working and are nothing to be concerned about.

When you’ve finished, press “Guardar” (save) go back to the “Resumen de declaraciones” summary for a final check.

Finally, I like to click on “Vista previa” to read through everything I’m submitting. When you’re ready, click “Presentar declaración” and follow the steps as before to finish and send your Declaración de la Renta.

Done! So… was this article helpful? Do you have extra information? Leave a comment and let me know!